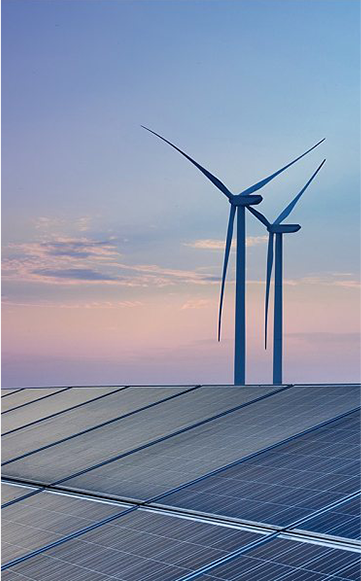

EU CBAM Service Platform

Simplifying your reporting and analysis for EU CBAM.

Automatically generate a CBAM report with just a few clicks.

What is a CBAM(Carbon Border Adjustment Mechanism)?

CBAM

In May 2023, the European Union officially implemented its Carbon Border Adjustment Mechanism (CBAM), covering steel, cement, aluminum, fertilizers, electricity, and hydrogen.

- CBAM Transitional Phase (October 2023 - End of 2025):

-

Basic Requirement: Imported taxable products entering the EU must provide carbon emissions reports.

Reporting Frequency: Quarterly and annual carbon reports are required.

- CBAM Definitive Regime(From January 2026)

-

Importers will be obligated to purchase CBAM-certificates.

Verification by an external independent body will be mandatory from 2026.

Compliance with CBAM: What are the challenges?

-

Lack of Risk Awareness

Related companies haven't formulated a plan to deal with green trade, and was passively responding to requests. -

High Professional Threshold

The high degree of specialization in interpreting exacerbates the difficulty in understanding policies. -

High Cost and Long Duration

Additional talent required, resulting in more costs. -

Difficulty in Obtaining Emissions Data

The amount of data filling is huge, the types of data are diverse, and the difficulty of parsing is high.

Trusted by more than 1000+ clients because

-

Automatically generate 100% compliant CBAM reports

-

Automatically retrieve data and digitize CBAM reports

-

Interpretation and tracking analysis of international carbon tariff related policies.

-

Provide carbon management and carbon reduction suggestions.

Future-proof your imports with a CBAM-expert

We provide tool to perform CBAM-related tasks, as well as a range of services tailored to our clients’ needs, including data collection checklists, assisted data collection, report writing, and expert consultation throughout the process. We help our clients automate their CBAM reporting obligations at a reduced cost.

-

CBAM Reporting

CBAM Reporting -

Product Management

Product Management -

Importer Management

Importer Management -

Visual Chart Analysis

Visual Chart Analysis

-

Consulting Services

-

Data Collection

-

Expert Q&A

-

Report Writing

CBAM Q&A

-

01

What happens during the transitional period?

Answer: During the transitional period of the CBAM, from 1 October 2023 until 31 December 2025,

the importer shall submit a CBAM report on a quarterly basis. This report shall include the information on the goods imported during the previous quarter and should not be submitted later than one month after the end of that quarter. -

02

To whom should the report be submitted?

Answer: The authorized declarant (EU importer or indirect customs representative) is required to submit the report to the EU CBAM competent authority. The supplier in other countries need to calculate embedded carbon emissions data and provide quarterly reports to declarants. Therefore, in order to facilitate exports, it is recommended that relevant exporters prepare in advance. -

03

Can a small amount of goods be exported to the EU without declaring CBAM?

Answer: During the transition period, the EU implements an exemption policy for some goods. Each batch of goods shall not exceed 150 euros;

2. Military use exemption;

3. Countries exempted from the European Free Trade Area are not bound by the CBAM;

4. Limited exemption for electricity imports: When non EU countries are integrated into the EU's internal electricity market and there is no CBAM technology solution for such electricity products, they can enjoy exemption. -

04

The CBAM carbon emission report is incorrect. Can it be corrected?

Answer: It can be corrected.

The CBAM report can be revised within 2 months after the end of each season. The first two reports during the transition period have buffer space and can be revised before the deadline of the third quarter report. -

05

During the transitional period of CBAM, will there be penalties for applicants who fail to declare on time or make false declarations?

Answer: Yes.

Reporting declarants may face penalties ranging between EUR 10 and EUR 50 per tonne of unreported emissions.