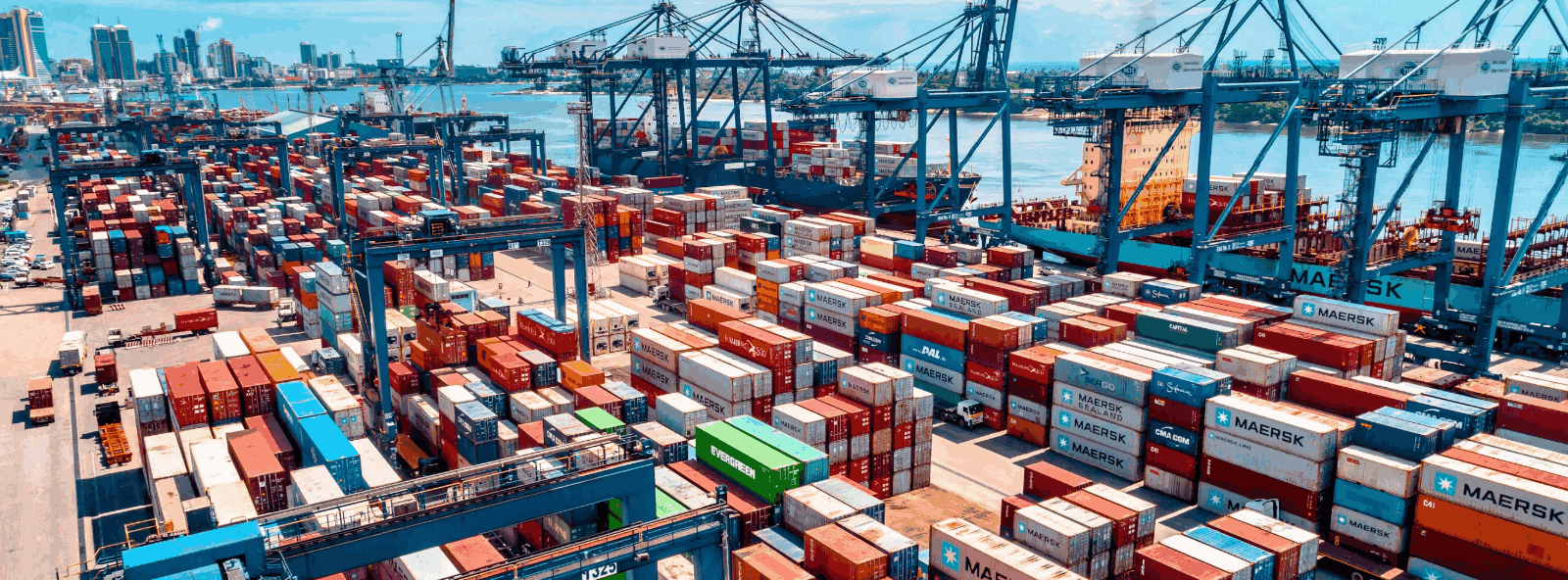

From complexity to simplicity, complete supply chain CBAM data collection in minutes,effortless CBAM Compliance

The EU Carbon Border Adjustment Mechanism (CBAM) is a key policy designed to prevent carbon leakage by leveling the carbon cost between imported goods and those produced within the EU. It applies a carbon price—linked to the EU Emissions Trading System (EU ETS)—on high-emission imports such as steel, cement, aluminum, fertilizers, electricity, and hydrogen. This ensures that non-EU producers bear comparable carbon costs to EU manufacturers. Starting in 2026, CBAM will be rolled out in phases. Importers will be required to buy CBAM certificates based on actual emissions, while the EU gradually removes free ETS allowances from domestic industries. As a result, the mechanism supports global decarbonization while reducing the risk of carbon leakage. However, businesses face major challenges. CBAM reporting is highly technical and must follow the EU’s strict Communication template. In addition, most companies struggle with traceability—collecting multi-tier supplier data can take weeks, and manual emissions calculations often lead to errors. To address these issues, our CBAM Reporting Tool simplifies the entire process. It enables secure collaboration across supply chains, collects accurate emissions data, and removes the need for manual input. Furthermore, it can generate CBAM-compliant reports within minutes, helping businesses stay compliant while saving time and reducing costs.

Fines of €10-50 per tonne for unreported emissions, with 2-month correction window.

Mandatory reporting during 2023-2025 transition, full enforcement from 2026.

The default value is no longer available, and the submission deadline for the next CBAM report is approaching swiftly.

Our intuitive digital tool helps you manage and verify carbon emissions, streamlining your efforts and empowering a smarter, more effective sustainability strategy.

The CBAM Regulation applies to CN codes (Combined Nomenclature), which adds two digits to the HS code and is used as a commodity code for exports outside the EU. All goods for which the embedded emissions must be reported are listed in Annex I to the CBAM Regulation. These are called ‘CBAM goods’. Sectors such as ‘iron and steel’ are mentioned only for informational purposes. For example, this means that imports of ammonia (CN code 2814 10 00 or 2814 20 00 under the fertilizer sector) are covered by the CBAM Regulation even if the ammonia is not used to produce fertilisers.

Since 1 October 2023, reporting embedded emissions in CBAM-covered goods has become mandatory. Declarants who fail to comply may face financial penalties ranging from EUR 10 to EUR 50 per tonne of unreported emissions. If a CBAM report is missing, inaccurate, or incomplete, the national competent authority (NCA) may initiate a correction process, allowing the declarant to amend any identified issues. Penalties may still be applied if: (a) the declarant has not taken reasonable steps to submit the required report, or (b) the report remains incorrect or incomplete despite the opportunity to make corrections.

The following table provides an overview of the specific emissions and greenhouse gases covered and how direct and indirect emissions are determined for each sector falling under the CBAM scope. Each sector’s particularities have been taken into account when designing the methods for reporting and calculating embedded emissions in these goods while mirroring the EU Emissions Trading System.

It can be corrected. The CBAM report can be revised within 2 months after the end of each season. The first two reports during the transition period have buffer space and can be revised before the deadline of the third quarter report.

Reporting declarants may face penalties ranging between EUR 10 and EUR 50 per tonne of unreported emissions.